Revenue Performance Model 4256553258 for Profit Growth

The Revenue Performance Model 4256553258 offers a structured approach for organizations seeking to optimize profit growth. It emphasizes the importance of analyzing revenue streams alongside key performance indicators, such as customer acquisition cost and lifetime value. Successful adoption hinges on interdepartmental collaboration and overcoming common obstacles. As businesses navigate these complexities, the potential for transformative results invites further exploration into its practical applications and success stories.

Understanding the Revenue Performance Model 4256553258

Although the concept of a Revenue Performance Model may appear straightforward, its implications for profit growth are multifaceted and grounded in data analysis.

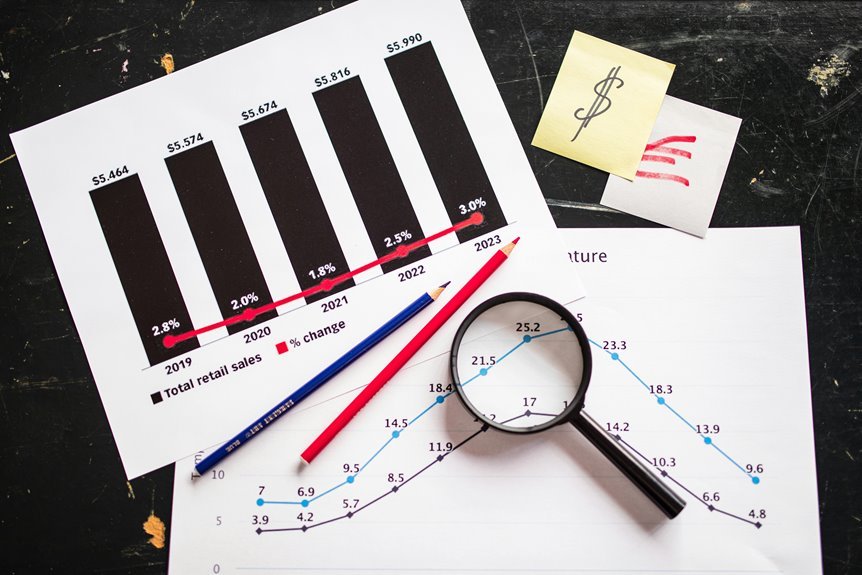

This model integrates revenue forecasting with performance metrics, allowing organizations to assess financial health accurately.

Key Components and Metrics for Revenue Analysis

A comprehensive understanding of key components and metrics is essential for effective revenue analysis.

Identifying diverse revenue streams allows organizations to assess financial health. Performance metrics such as customer acquisition cost, lifetime value, and revenue growth rate provide critical insights into revenue dynamics.

Strategies for Implementing the Revenue Performance Model

Understanding the key components and metrics for revenue analysis lays the groundwork for effectively implementing a Revenue Performance Model.

Organizations must address implementation challenges by fostering strategic alignment across departments. This requires clear communication of objectives and metrics, ensuring all stakeholders are engaged.

Regular evaluations of performance metrics will facilitate adjustments, enhancing adaptability and ultimately driving profit growth through informed decision-making.

Case Studies: Success Stories of Profit Growth Using the Model

As organizations increasingly adopt the Revenue Performance Model, numerous case studies illustrate its effectiveness in driving profit growth.

For instance, Company A increased its profit metrics by 30% within a year, while Company B streamlined operations, achieving a 25% rise in net income.

These success stories highlight the model’s ability to enhance financial performance, offering valuable insights for businesses seeking sustainable profit growth.

Conclusion

In conclusion, the Revenue Performance Model 4256553258 emerges as a transformative powerhouse, catapulting organizations to unprecedented heights of profit growth. By meticulously dissecting revenue streams and performance metrics, companies can unlock a treasure trove of financial insights, transcending traditional barriers and resistance. This model not only ignites strategic alignment but also ensures a steadfast commitment to data integrity, propelling businesses toward a future where sustainable growth becomes the norm, rather than the exception, in the competitive marketplace.